Over half of the countries around world have committed to achieve net zero emissions (Net Zero Tracker, 2025). While resource-rich nations such as Indonesia target 2060, Singapore, a small nation with limited natural resources, faces the tougher task of reaching net zero by 2050 with limited domestic renewable options

Currently, Singapore relies heavily on fossil fuels for power generation, mainly natural gas, which is already cleaner than other fossil fuels options. Today, about 93% of Singapore’s electricity comes from natural gas (EMA, 2025), with most generation capacity relying on Combined Cycle Gas Turbine (CCGT) plants; solar and other sources fill a small share (EMA, 2025). Singapore imports natural gas via gas pipeline from Indonesia and Malaysia, and via liquefied natural gas (LNG) terminals.

In its 2022 Low-Emissions Development Strategy (LEDS) addendum, Singapore committed to reduce its emissions around 60 MtCO2e in 2030 after peaking earlier, further decline to 45-50 MtCO2e in 2035, and ultimately achieve Net Zero Emissions by 2050. Power generation sector, which accounts for over one-third of Singapore’s total emissions (59 MtCO₂e in 2022) (NCCS, 2025), becomes a critical sector in order to achieve Net Zero by 2050.

Reducing emissions from the power sector is particularly challenging due to Singapore’s limited land area and scarce renewable resources. Low wind speeds, limited tidal ranges, modest wave energy potential, and the absence of geothermal resources make large-scale wind, marine, or geothermal power generation less feasible (IMCCC, 2020). Solar power is the most viable option for Singapore to generate its own clean energy, despite limited land area.

To address these challenges, Singapore develops plan called “Four Switches”. The first switch is natural gas. Natural gas continues as the main source of electricity in the near future. Singapore Economic Development Board (EDB) projected that the electricity energy mix of natural gas will decline to 50% in 2035. To reduce emissions, Singapore focuses on more efficient and advanced power plants technology.

However, with pipeline gas contracts from Indonesia set to expire in 2028 following their 2023 extension, the future of Singapore’s natural gas supply is less certain. One likely outcome is that Singapore will increasingly rely on LNG, as gas from South Sumatra and Natuna will be redirected to meet Indonesia’s growing domestic demand in Western Java and Batam. This aligns with the Indonesian government’s current policy of prioritizing domestic energy needs. Moreover, the natural decline of South Sumatra’s gas fields further complicates efforts to balance domestic consumption with export commitments to Singapore.

The second switch is solar energy, where Singapore has already installed around 1.6 GWp of capacity. By 2030, Singapore aims to deploy at least 2 GWp of solar capacity, equivalent to about 4% of today’s annual electricity demand and roughly 10% of peak daily demand (IMCCC, 2020). Solar PV systems are being deployed on building rooftops, facades, reservoirs, offshore waters, and vacant land to address Singapore’s land constraints. To mitigate the intermittency of solar power, Singapore is developing advanced solar forecasting models and expanding the use of energy storage systems (ESS).

Solar energy can only satisfy a fraction of Singapore’s electricity demand. This is where the third switch comes in: regional power grids. Despite lacking renewable energy resources, Singapore is surrounded by countries that have abundant potential renewable energy. In 2022, Singapore launched a pilot project to import up to 100 MW of renewable hydropower from Laos, transmitted via the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP) (EMA, 2025). Its second phase expanded the electricity imports to maximum 200 MW, incorporating additional renewable supply from Malaysia.

Building on this pilot initiative, Singapore is now scaling up its regional power import and aiming to import 6 GW of clean electricity by 2035 (EMA, 2025), equivalent to around 30% of its projected power supply (EDB, 2024). Singapore Energy Market Authority has granted conditional approvals to multiple cross-border power import projects from Indonesia, Vietnam, Cambodia, and Australia, of which six have progressed to receive Conditional Licences. In Indonesia’s Riau Islands, companies such as Adaro, Medco Power, EDPR, and Keppel Energy are developing large-scale solar and storage projects in Batam, Bulan, Combol, Citlim, and Sugi Islands, with each capacity ranging from several hundred megawatts up to 600 MW.

The last switch is emerging low-carbon alternatives. Singapore also considers unconventional clean energy sources, such as hydrogen. Hydrogen is considered an emerging clean fuel that could, in the long term, replace the role of natural gas in Singapore’s power generation mix. However, hydrogen usage as a fuel is still in early stage and not adopted widely yet. Currently, Singapore is exploring the use of low-carbon ammonia for power generation and maritime bunkering on Jurong Island. Besides hydrogen, Singapore is also studying longer-term or less immediately viable low-carbon solutions, including geothermal energy, nuclear power, and carbon capture and storage (CCS).

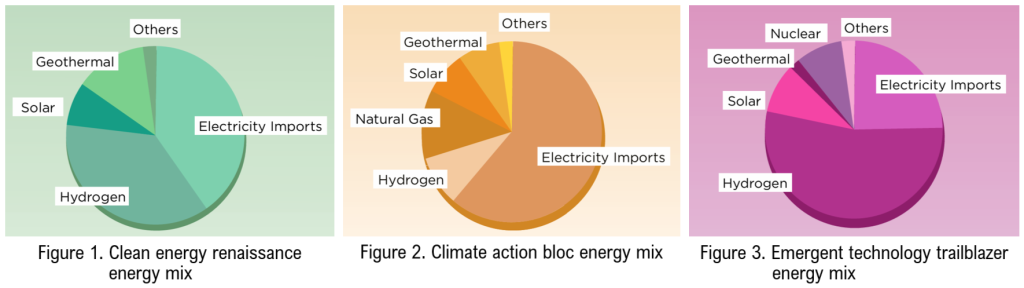

In 2022, the Singapore Energy 2050 Committee published a report outlining possible pathways for Singapore’s power sector to achieve net zero emissions by 2050. The report examines key trends, uncertainties, and strategic options for Singapore’s future energy system. It presents three distinct scenarios for how Singapore could achieve net zero emissions in 2050:

- Clean Energy Renaissance: strong international collaboration and rapid technological advancement

- Climate Action Bloc: effective global cooperation, though technological progress advances more slowly

- Emergent Technology Trailblazer: limited global cooperation compels Singapore to invest heavily in its own low-carbon technologies

Each scenario has different preconditions and therefore results in a different projected energy mix for 2050. Despite their differences, all scenarios highlight electricity imports and/or low-carbon hydrogen as the dominant components of Singapore’s 2050 energy mix.

Based on these scenarios, The Committee also recommends a balanced strategies across supply (more imports, solar, hydrogen, and CCS), grid resilience, and demand-side management.

As Singapore becomes increasingly dependent on electricity imports rather than natural gas for its power supply, Indonesia can capitalize on this opportunity and shifting from exporting natural gas to exporting electricity to Singapore. The plan to export electricity to Singapore has been included in recent Indonesia Electricity Supply Plan (RUPTL). Through the ongoing solar projects in the Riau Islands, Indonesia will contribute to Singapore target of importing 6 GW of clean electricity. However, the potential lies behind the Riau Islands: Sumatra. Sumatra also has significant hydro and geothermal resources, which offer advantages over solar power such as higher capacity factors and greater reliability. RUPTL stated that the potential electricity export from Sumatra reach 1.1 GW, with potential transmission route is Sumatra-Singapore or Sumatra-Batam-Singapore.

In the longer term, Indonesia could also benefit from Singapore’s growing reliance on low-carbon hydrogen. Low-carbon hydrogen is produced by electrolysis of water, which require large amounts of electricity. Indonesia can utilize its hydro, geothermal, solar, wind, and other clean energy sources to produce low-carbon hydrogen and export it to Singapore. This can be done as hydrogen technology and market develop in the next decades. However, with Indonesia’s potential export of renewable energy to Singapore, Indonesia needs to find the balance of fulfilling Singapore Net Zero target in 2050 and its own Net Zero target in 2060.

References

– Economic Development Board. (2024, January 4). What could Singapore’s energy mix look like in 2035? Retrieved September 2025, from https://www.edb.gov.sg/en/business-insights/insights/what-could-singapores-energy-mix-look-like-in-2035.html

– Energy 2050 Committee. (2022). Energy 2050 Committee Report. Singapore: Energy Market Authority.

– Energy Market Authority. (2024). Singapore Energy Statistics 2024: Energy Transformation. Retrieved September 2025, from https://www.ema.gov.sg/resources/singapore-energy-statistics/chapter2

– Energy Market Authority. (2025). Energy Supply. Retrieved September 2025, from https://www.ema.gov.sg/our-energy-story/energy-supply

– Energy Market Authority. (2025). Plant Mix for Electricity Generation. Retrieved September 2025, from https://www.ema.gov.sg/resources/statistics/plant-mix-for-electricity-generation

– Inter-Ministerial Committee on Climate Change (IMCCC). (2020). Long-Term Low-Emissions Development Strategy (LEDS). Singapore: National Climate Change Secretariat.

– National Climate Change Secretariat. (2025). Overview of Singapore Climate Targets . Retrieved September 2025, from https://www.nccs.gov.sg/singapores-climate-action/singapores-climate-targets/overview/

– National Climate Change Secretariat. (2025). Singapore’s Emissions Profile. Retrieved September 2025, from https://www.nccs.gov.sg/singapores-climate-action/singapores-climate-targets/singapore-emissions-profile/

– Net Zero Tracker. (2025). Retrieved September 2025, from Net Zero Tracker: https://zerotracker.net/

– PT PLN (Persero). (2025). Rencana Usaha Penyediaan Tenaga Listrik (RUPTL) 2025-2034. Jakarta: Kementerian ESDM.