South Sumatra is one of Indonesia’s most productive hydrocarbon basins, with decades of success from conventional reservoirs such as Talang Akar, Air Benakat, and Gumai. Beneath these mature plays lies substantial unconventional potential in coalbed methane (CBM) and shale/tight gas. However, despite this promise, unconventional development has remained limited, constrained by a combination of geological complexity, technical readiness, commercial viability, and regulatory challenges.

Subsurface Constraints

The first challenge lies in the subsurface. Unconventional resources are highly sensitive to reservoir variability, and South Sumatra’s geology is far from uniform. Coal and shale intervals differ significantly in thickness, continuity, brittleness, and natural fractures, while pressure and fluid behavior are often complex. CBM requires extensive dewatering to initiate gas flow, whereas shale and tight gas depend on carefully engineered hydraulic stimulation. These conditions make it difficult to directly apply “off-the-shelf” unconventional techniques developed in the United States or Australia.

Technical Constraints

Technical and operational limitations present a major obstacle. While Indonesia has strong experience in conventional oil and gas, its exposure to unconventional development remains limited. Horizontal drilling in thin, heterogeneous targets is not yet standard practice, and geosteering to keep laterals within brittle, gas charged zones has been applied only selectively. In addition, multi-stage hydraulic fracturing is not yet available at the scale required for repeated, high-intensity campaigns. Together, these capability gaps increase both the cost and execution risk of early unconventional pilots.

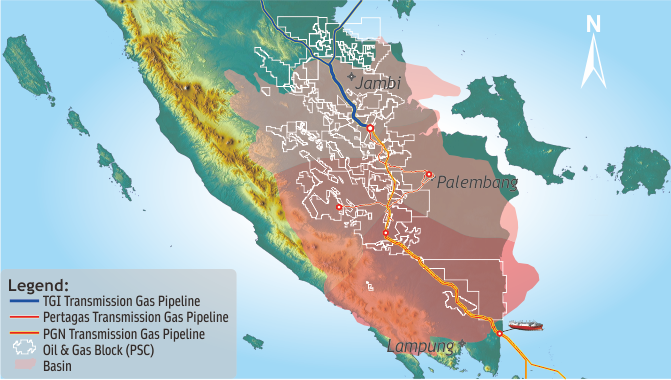

Infrastructure Constraints

Infrastructure adds further complexity to unconventional gas development. These projects require extensive gathering systems, compression, water management, and access to processing plants or transmission pipelines. Many prospective areas in South Sumatra are located far from existing infrastructure, leading to higher upfront capital costs and operational uncertainty. Conversely, prospects located near pipelines such as SSWJ or Grissik–Duri may face constrained economics due to transportation tariffs. In this context, partnerships with experienced global unconventional operators, service providers, and pipeline owners are critical to improving cost efficiency, reducing risk, and accelerating commercialization.

Commercial Constraints

The commercial landscape presents further challenges. Unconventional wells typically require higher upfront capital and deliver lower initial production than conventional wells, often resulting in marginal economics under current fiscal terms. South Sumatra gas also faces competition from cheaper conventional supply, imported LNG, and alternative fuels, increasing market uncertainty. Without long-term offtake certainty, operators are unlikely to commit to multi-year drilling programs. Targeted incentives such as improved cost recovery, more flexible PSC terms, and policy support for early pilots are therefore critical to improving project viability.

Coalbed Methane vs. Shale/Tight Gas

When focusing on the types of unconventional gas resources, coalbed methane (CBM) and shale/tight gas follow very different development pathways. CBM resources and fairways in South Sumatra are partially mapped, with the main challenges now centered on economic extraction, commercialization, and regulatory support. In contrast, shale/tight gas remain at an early stage, with efforts still focused on data acquisition, geomechanical understanding, and technology evaluation. As a result, shale and tight gas are likely still some distance from commercialization, making CBM the more near-term opportunity for market development.

Conclusion

Despite these challenges, South Sumatra’s unconventional resources hold strategic value for Indonesia’s long-term energy resilience, domestic gas diversification, and downstream industrial growth. Unlocking this potential requires coordinated progress across subsurface understanding, technical capability, infrastructure, commercial frameworks, and regulatory support. South Sumatra has the resources and opportunity; what it needs now is alignment between geology and technology, operators and service providers, and policy direction and market demand to turn potential into meaningful production.