A quick recap on Northern Sumatera Energy Consumption.

From oil & gas development, Northern Sumatera stands as one of Indonesia’s earliest significant regions. Since the early 1900s, the Langkat region has housed vast oil reserves, laying the foundation for the development of the Pangkalan Brandan Refinery Unit. This pivotal moment marked the beginning of a rapid growth in oil and gas exploration in Northern Sumatera, outpacing other regions in the country.

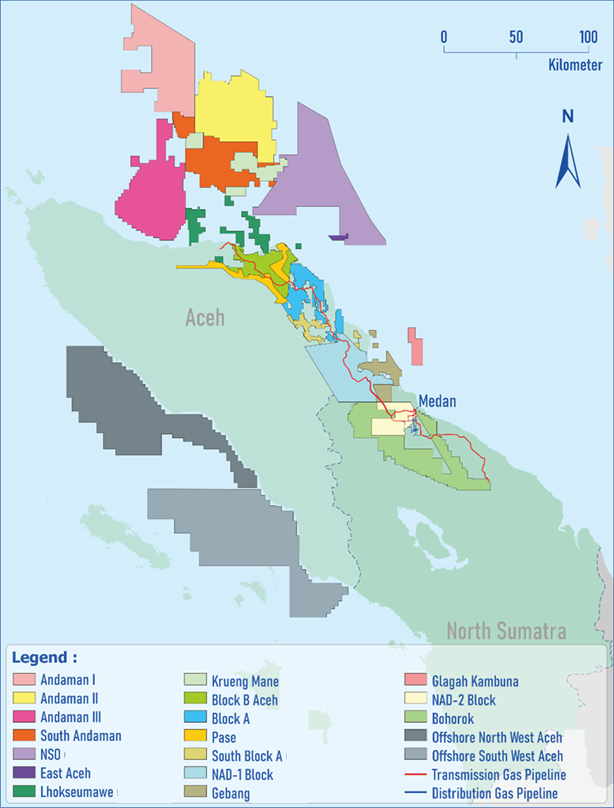

The discovery of the Arun field in 1971, with initial gas reserves of 13 Tcf, solidified Northern Sumatera’s position as a prominent region in the industry. By the 1980s and 1990s, Arun had become the largest producing gas field in Indonesia. Due to its impressive deliverability, the Arun gas found a primary market in exports, with LNG cargo serving as the primary transportation method. Furthermore, major industries heavily reliant on natural gas, such as PT Pupuk Iskandar Muda, PT Aceh Asean Fertilizer, and PT Kertas Kraft Aceh, flourished near the Arun field during the 1980s. This led to the development of additional blocks, including Krueng Mane, Lhokseumawe, and ONWA-OSWA, as shown in the figure below.

The gas market in Northern Sumatera, due to limited infrastructure in the past, can be divided into two regions. The first region is the Aceh market, primarily comprising anchor buyers and LNG export buyers, served by Block B and NSO. The second region is the Medan greater area market, mainly consisting of industrial estates as buyers, initially supplied by Pertamina through the Wampu pipeline. The strategic location of Northern Sumatera to the ASEAN market has fostered stable growth in the manufacturing sector in Medan, catalyzing the development of the SEZ (Special Economic Zone) status industrial estate in Sei Mangkei.

As time progressed, Pertamina faced the challenge of depleting gas supplies, creating a threat to the security of natural gas supply in North Sumatera. To address this issue, the massive Arun-Belawan pipeline was constructed and commissioned in 2015 to supply the Medan market. The Medan market encompasses natural gas for electricity generation, the manufacturing sector, and the growing industrial estate of KEK Sei Mangkei. Currently, the majority of gas supply is sourced from regasified LNG for gas-fired power plants, with the remaining supply allocated to the manufacturing sectors.

To help the end-user about the gas price, regulations have been enacted to promote the use of natural gas. The first regulation, ESDM Ministerial Decree 434 K/12/MEM 2017, tackles the issue of gas prices. It stipulates a change in upstream gas prices from $7.85 – 8.24/MMBtu to a floating scheme based on ICP ($6.82 – 6.95+1%ICP/MMBtu). The price reduction is accompanied by a decrease in transmission fees. The fees for the Arun-Belawan (PHE NSO gas) and Pangkalan Susu-Wampu (PEP gas) routes have been reduced from $2.78/MSCF to $1.88/MSCF and $0.92/MSCF to $0.8/MSCF, respectively, while the Arun-Belawan from Triangle Pase remains unchanged at $1.88/MSCF. As a result, end-users now pay approximately $9.95/MMBtu, down from the previous $13.38/MMBtu.

The COVID-19 pandemic evoked the issuance of special gas prices on a national scale to support manufacturers in Indonesia. Through Ministerial Decree 89 K/10/MEM/2020, the government adjusted upstream and midstream prices to set the gas price at the plant gate around $6/MMBtu. Subsequently, the 2020 decree was revoked and replaced by 134 K/HK.02/MEM.M/2021. In order to reduce the gas price, the Indonesian government’s share will be deducted alongside adjustments to infrastructure costs.

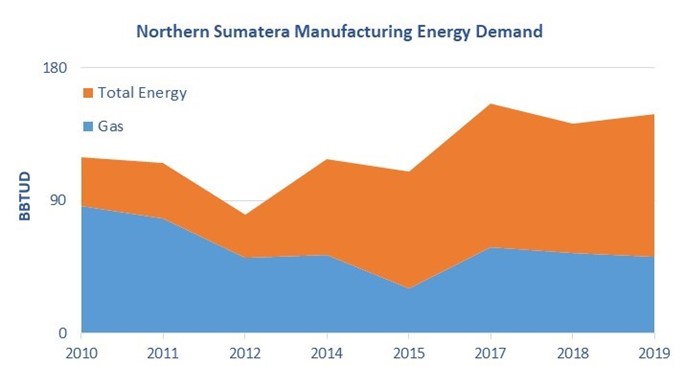

As shown in the figure above, until 2010, natural gas dominated energy demand in the manufacturing sector, estimated at around 90 MMSCFD. This was primarily due to the presence of PT Pupuk Iskandar Muda, a fertilizer anchor buyer, operating at nearly full capacity with the PIM-1 and PIM-2 plants. However, due to reserve depletion and deliverability concerns, only the PIM-2 plant remains operational, leading to a 50% reduction in natural gas consumption. Nonetheless, other manufacturing sectors have experienced rapid growth, as indicated in the figure above, with overall energy consumption steadily increasing, although with a massive decline in natural gas demand.

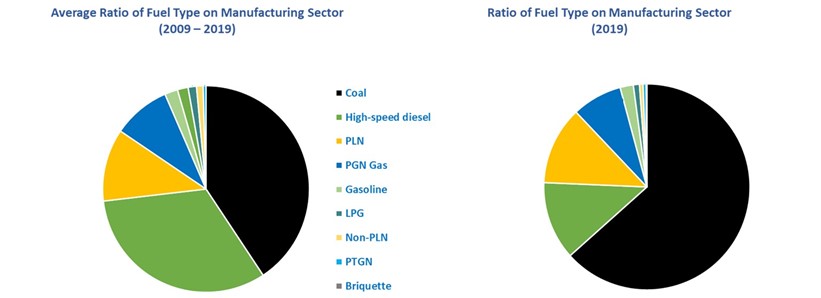

Based on our analysis, the surging energy demand in the manufacturing sector over the past decade has been primarily met by coal. As shown in the figure, coal’s share has increased by almost 50% compared to its 10-year average, while total non-natural gas energy demand has nearly doubled. This trend can be attributed to coal’s supply stability and competitive pricing. The substantial decrease in diesel and LPG usage, which has been replaced by coal, has also reduced the potential market for natural gas. One of the key factors contributing to this shift is might be the shortage of natural gas supply, compounded by the uncompetitive gas prices at the plant gate. Consequently, end-users have transitioned to alternative fuel sources to ensure stable and competitive production.

Currently, the shortage of natural gas supply is being managed by manufacturers by sourcing alternative fuel types. The upstream regulatory body must prioritize the security of supply through the development of indigenous gas fields. Aligned with the upstream side to secure the supply from indigenous gas fields, and considering the relatively uncompetitive LNG prices, the downstream gas aggregators should actively reclaim natural gas market share from manufacturers. Direct burning of natural gas for combustion offers cleaner energy compared to diesel and coal. In conclusion, the energy ecosystem in Northern Sumatera oblige exceptional synergy between upstream and downstream developments to address the challenges and harness the region’s full potential.

Source:

BPS National Industry Manufacturer Survey , 2015, 2019.